Introduction

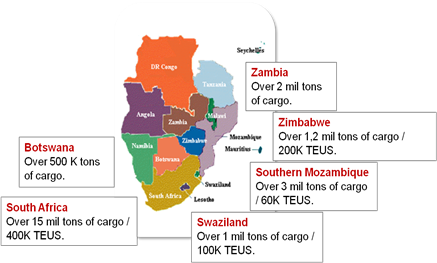

As a post-conflict country Mozambique recognises its role and opportunity to facilitate trade within the SADC region. The country sits within an important SADC regional trade corridor (north of the Ports of Richards Bay and Durban in SA and the Maputo Corridor). Further, it is and will be instrumental in promoting major economic development in surrounding countries (Zimbabwe, Botswana, Malawi and as far as the DRC, etc.); supporting NEPAD initiatives. It is in this environment that the port's vision is anchored To become a sustainable SADC regional port for the vibrant import and export of global trade markets.

The port's main objectives are to do the following:

- Consolidate cargo handling facilities and align cargo operations with best practice

- Optimize available land and berth space

- Provide additional infrastructure to create further port capacity

- Deliver the best returns to Conceding Authority and Shareholders

- Develop social up-liftment of the local community

- Drive sustainable economic development and poverty reduction within southern Mozambique

From the country's infrastructural decline of which the port was among, the port has made strides to refocus on its greatest asset, its location and potential access to major regional trade traffic for economic re-engineering.

Institutional Parameters

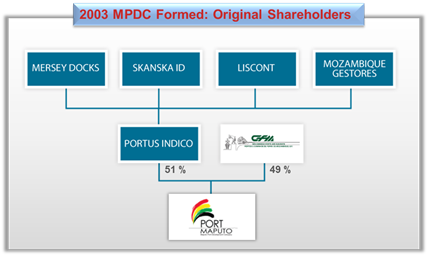

Protocols that factored management and operations include those related to public-private partnerships. The concessioning of the port in 2003 started a road where the Mozambique Government pioneered a transformational process for African ports to potentially follow as means for re-investment post-conflict and infrastructure devastation. The initial consortium formed in 2003 is presented below: Diagram 2: 2003 MPDC Original Shareholders.

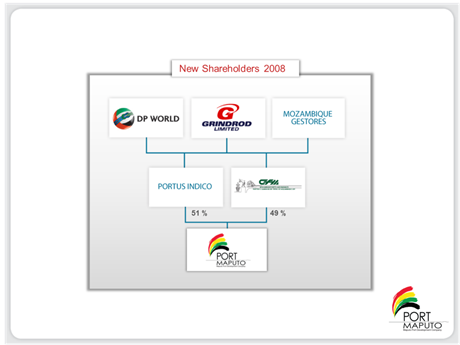

The consortium, the Maputo Port Development Company SA (MPDC), has undergone changes since 2003. The current line-up of investors is as follows:

- Mersek Docks and Harbour Company (lead investor from the UK)

- Skanska ( Swedish group)

- Liscont - Operadores de Contentores SA - mostly known for its work in Lisbon with Alcantara Container Terminal

- Grindrod Group ( new member of the consortium and South African)

- CFM-Portos e Caminhos de Ferro de Mozambique

Unidade de Gestão dos Projectos de Transportes e Comunicações - UGPTC

Ministério dos Transportes e Comunicações

Av. Mártires de Inhaminga nº336, 1ºandar - Maputo/Moçambique

Tel. (258 21) 324240

Fax: (258 21) 320745

E-mail: mtcugptc@tvcabo.co.mz /ugptcvmartins@tvcabo.co.mz

The Maritime sector in Mozambique is regulated by the Ministry of Transport and all Transport and Goods Movement policies formulated since the full functioning of the port are applicable. International protocols such as the agreements between South Africa, Malawi, etc. also form the broader umbrella whereby trade and movement of goods across borders encourage seamless transit regional trade. In addition protocols by IMO/SOLAS especially in terms of maritime safety at sea; International Ships and Port Security (ISPS-Part A and B) have not only been embraced, but the Ministry has been instrumental in assisting ISPS implementation at the port.

Introduction

Port Maputo has come out as a success story of a post-conflict country as it rebuilds its infrastructure for national economic recovery. The port covers approximately 129 hectares with 3,000 meters of quays ranging in depth from 8 to 12 meters.

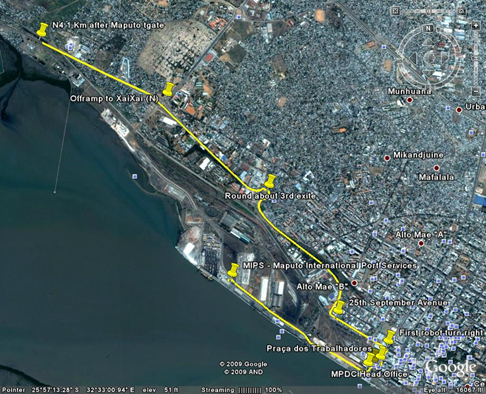

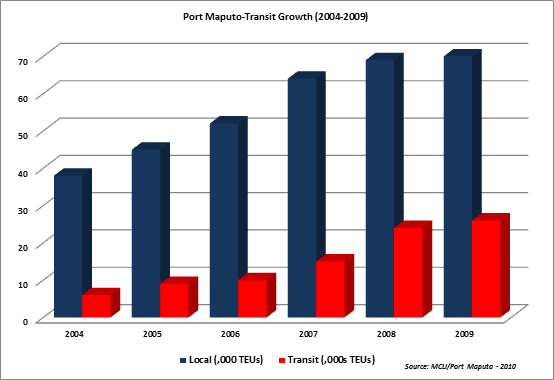

The port and the Maputo Logistics corridor function as a singular system since the success of one reflects on the other. This logistics freight corridor (provincial - M4 and national - N4); rail network (Ressano Garcia); and better designed and operational cross-border traffic has facilitated the port's redevelopment and performance. Since 2008 under reconfigured management/operations of MPDC, the port has handled over 6.5 million tons of cargo with 690 vessel arrivals.

Plan 2: Aerial View of Port Maputo - Source MPDC-Port Master plan 2009

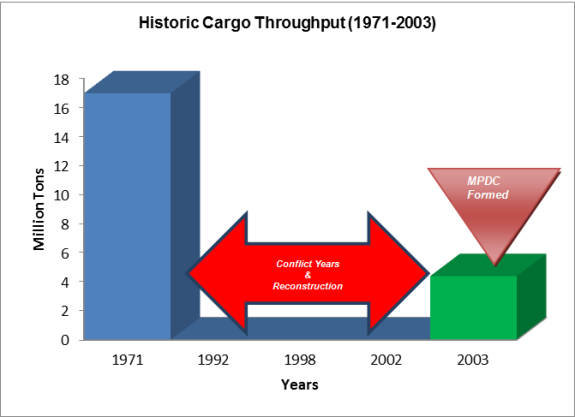

Diagram: Historic Cargo Throughput (1971-2003) - Source: Port Maputo and MCLI

Port Infrastructure

The most important function of inland infrastructure (road and rail) is to allow for access to freight platforms such as terminals, intermodal facilities as well as better movement of goods to the quay. In most ports, conveyor belt systems also form aspects of inland infrastructure as they facilitate movement of dry-bulk commodities such as coal, iron ore, etc. In addition, waterside infrastructure inclusive of terminals, quays, berths etc. form an element for port capacity and efficiencies.

Road Network

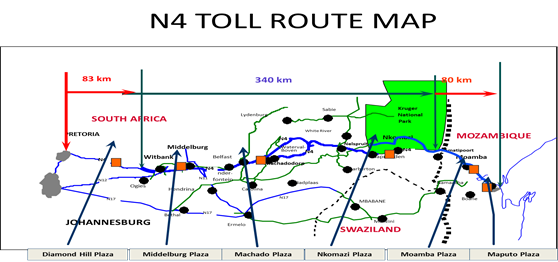

The port is linked by a 1.3 k road which provides access to South Africa's road network, namely, N4 - translating to about 550 km from Maputo to Gauteng. The N4 toll road from east Tshwane (Pretoria) is 503 km. Through this road network additional external access extends to Swaziland, Limpopo and Zimbabwe.

New Port Entrance (Source Port Maputo Webpage 2010)

Finally, the benefit of the new port access road is that it carries heavy road traffic by-passing downtown Maputo public/city traffic and connects the harbour direct with the M4 Highway running 600km westwards through the industrial and mining heartlands of South Africa.

Diagram: N4 Toll Road

Source: TRAC 2010

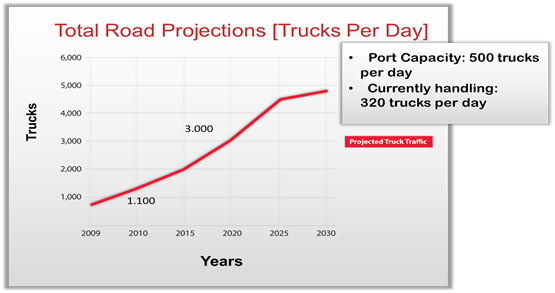

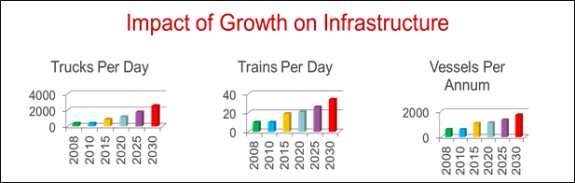

In the future (2015 - 2030) to ensure better logistics movement, capacity of 500 trucks per day will be planned vs. current handling of 320 trucks per day.

Graph: Total Projected Truck Traffic in the port Source: Port Maputo 2009

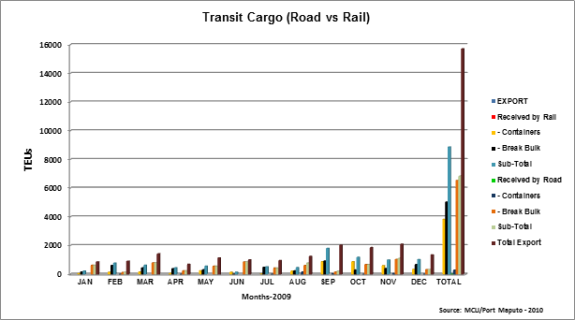

Rail Network (source: Port Maputo Webpage and Port Maputo MPDC-Yearbook & Directory 2008) Capacity of 13 million tonne per annum has been completed on the mainline to South Africa. In addition, the main line to central Zimbabwe has been rebuilt with generous American assistance and now offers 5 day transit times between Bulawayo and Maputo.

An international consortium led by NLPI, (New Limpopo Bridge Project Investments), together with Transnet Freight Rail (TFR) and CFM, the national rail operators of South Africa and Mozambique respectively, have signed a 15-year Concession Agreement to privatise the railway from the South African border through to the ports of Maputo and Matola. The Ressano Garcia Railway Company invested approximately US$10 million to rehabilitate the railway line, modernising and improving it to the same standard as the South African network, providing a seamless rail link along the Maputo Corridor. The company projects that freight traffic will increase from 2.9m tonne to more than 6.8m per annum. Feasibility studies for electrifying the line will be carried out if justified by future volumes.

Port Facilities

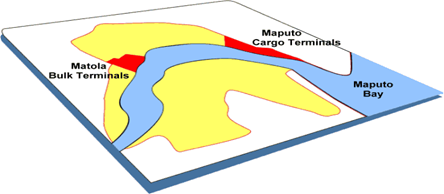

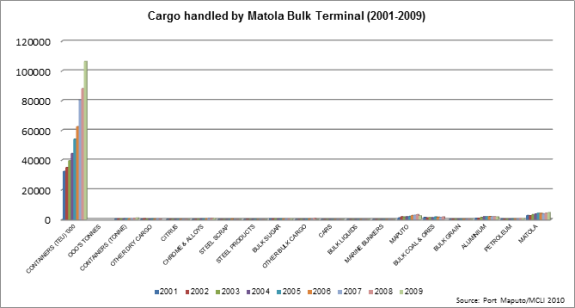

The port contains two terminal developments and operations: Maputo Container Terminals and Matola Terminals. These two areas have working cargo terminals handling a variety of commodities ranging from containers, magnetite, ferrochrome, citrus, bagged sugar and coal, to name but a few. In addition, the port has a small dry dock, and mobile welding and repair services are available at all berths.

Port Terminals

Port Maputo Cargo Terminals operates on a 24 hours a day covering an area of seven hectares. Berth profile is 300 meters with depth of 11 meters. The container terminals handle containerized cargoes of fish products, rice, sugar, fruit, construction materials, and vehicles as well as a variety of other goods. The terminals have capacity to handle 100 thousand TEUs per year, with 68 reefer plug points.

Diagram 8: Port Terminal Orientation Source: Port Maputo Webpage 2010

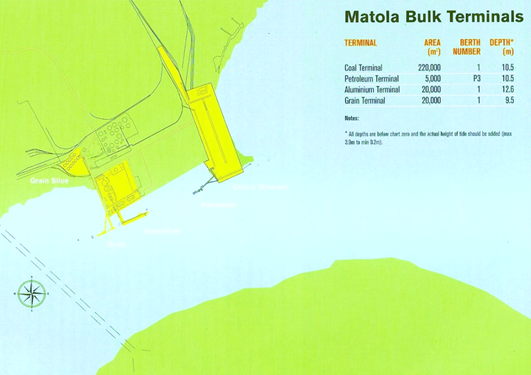

Diagram 10: Matola Bulk Terminals Source: Port Maputo MPDC Yearbook 2008

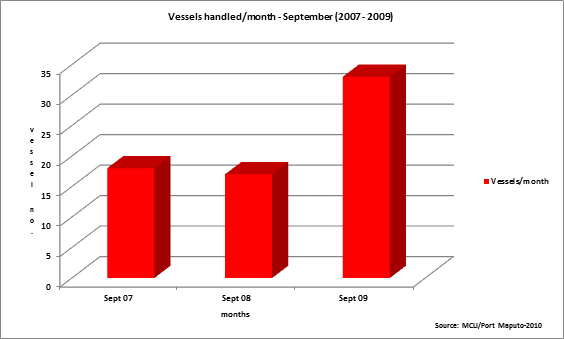

Port Activity: Cargo Handled, Vessel Arrivals and Volumes

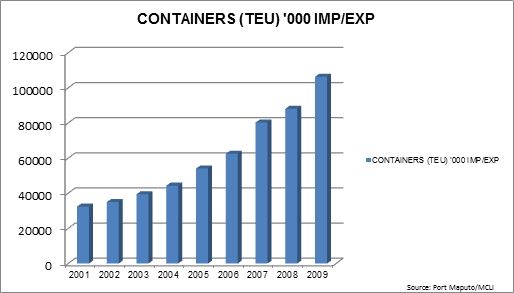

Containers Handled 2001-2009

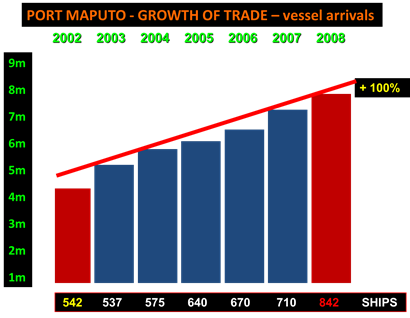

Port Growth: Cargo volumes and Vessel Arrivals (2002-2009) - Source Port Maputo/MCLI 2010

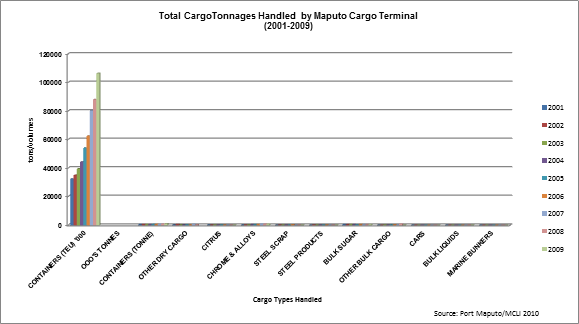

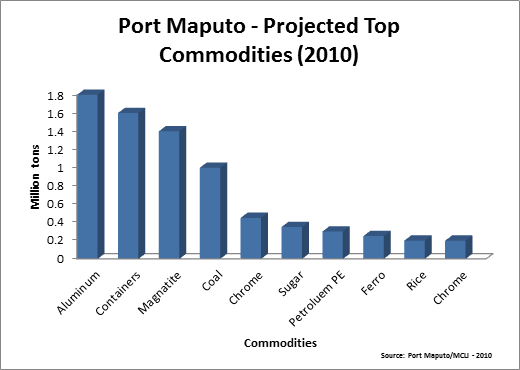

Top Commodities Handled 2010

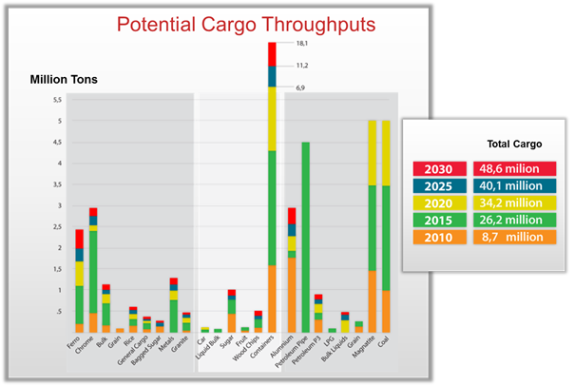

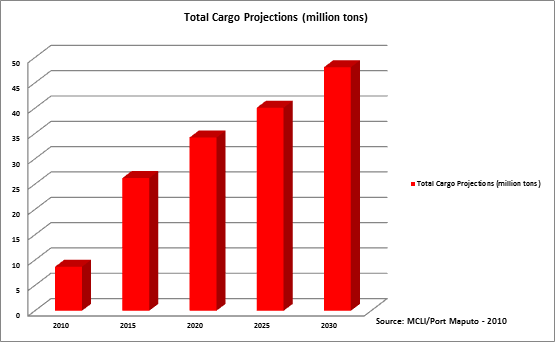

Demand Forecast (2009-2030)

Based on the port master plan conducted in 2008, the port development program takes into account an optimistic growth curve to the functioning and demand for port infrastructure over the next 30 years. The timeframe is 2010 to 2030 focusing on inland (rail and road) infrastructure, waterside berths, dredging and equipment) infrastructure.

This section presents the projected cargo volume throughputs within this time frame; likely impact of growth on infrastructure and how it will be achieved (i.e. Capex requirement, etc.).

Source: Port Maputo Master plan 2009

Projected Total Cargo Throughput (2010 - 2030)

Projected Port Activity and impact on Infrastructure (2008-2030) - Source: Port Maputo Masterplan - 2008

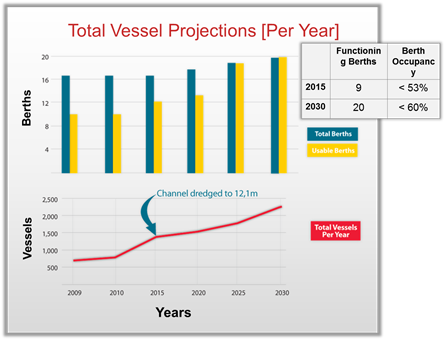

Projected Vessel Arrivals (2009-2030)

Source: Port Maputo Masterplan - 2008

Port Maputo is poised at fulfilling its historical role as a preferred transit port in Southern African. However it is important to note that incremental growth will transpire which means optimistic growth curves of achieving over 48 million tons of cargo by 2030 will have to be monitored and percentage growth adjusted.

Similar to South Africa, challenges rest on uncertainties of world economies and regional trade forces (especially in exports) as most of these economies are still heavily skewed towards raw-material export. Export-based markets of such cargo have healthier margins if there is critical mass of demand which drive prices up. For the port to achieve its vision and meet its socio-economic development mandate, diversified, value-added cargoes must form the repertoire of those handled at the port. To promote more transit, completed infrastructural projects and processing systems at the border and efficiencies at the port are mandatory. Also, maintaining the collaborative partnership with ports in South Africa will go a long way in creating an environment of complementarity, thus having a collective vision for capital investment and eliminate duplication of services. This however does not mean the port should not take opportunity when they are the better performer in meeting customer needs.

Copyright © 2012 Limpopo Province Freight Transport Data Bank | Developed and Powered by Safiri South Africa.