Forestry & Paper

Limpopo's timber industry is concentrated in the eastern regions. Forests stretching northwards and eastwards of Tzaneen are a major source of pine and eucalyptus timber. The province, and especially the town of Tzaneen, has a large number of sawmills which form an important part of the regional economy, providing a base to drive other subsectors such as furniture making.

About 63 000ha of the province's landmass is under forest, and approximately 680 000 cubic metres of round wood is produced annually. Nearly 100 000 cubic metres of this wood is used by companies in the mining sector. Pulp and paper production are not undertaken in the province.

Institutional Framework

The forestry sector sits under the Department of Agriculture, Forestry and Fisheries (DAFF) - former DWAF. Additional key institutional arrangements come from the Department of Environmental Affairs and Tourism (DEAT) Department of Land Affairs, and the Department of Trade and Industry. Influential protocols include, but are not limited to the following:

National Legislation:

- National Forests Act No. 84 of 1998 (NFA)

- National Environmental Waste Management Bill

- National Water Act of 1998

- National Air Quality Act (NAQA) - relates to processing, air pollution and those engaged in in recycling. This is the amended version of the APPA.

- 1965 Atmospheric Pollution Prevention Act (APPA) - based on the British Clean Air Act

Protocols and Charters

- Forest Sector Transformation Charter

- Protection of Informal Land rights Act (Act 31 of 1996)

- Communal Land Rights Act (Act 11 of 2004)

- Forest Stewardship Council (FSC) - ISO 14001

- South African Forestry Company Ltd - SAFCOL

- Atmospheric Emissions Licenses (AELs)

- Commission on Restitution of land Rights - CRLR

- Etc.

The sector has been identified as one of the important contributors to the Accelerated and Shared Growth Initiative for South Africa as a result of its intensive operations, which involve the employment of people from the rural communities of South Africa. (DAFF, Annual Report, 2009/10)

Overview

Figure 1 : Distribution of Forest Plantations in South Africa Source: Robert Prinz - 2011

The forestry sector in South Africa emerged after the end of World War I. It was primarily owned and managed by the state (government). This allowed the paper & pulp industries as well as the supply of "forest-raw materials" to grow into a major gross domestic product (GDP) contributor. In the 1980s the industry finally entered the global market achieving a R20 billion sector in charge of providing millions of tons, especially exports for (pulp and paper) annually.

The Department of Agriculture, Forestry and Fisheries is responsible for the following:

- production and resource management

- Agri-support services

- Trade and Economic development

- Food safety

- Bio-security, Forestry, and

- Marine Aqua-culture

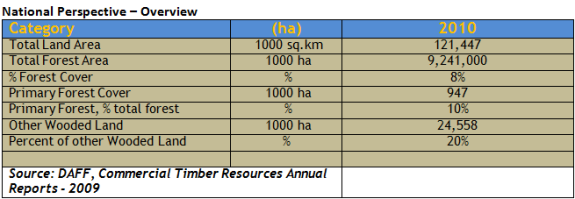

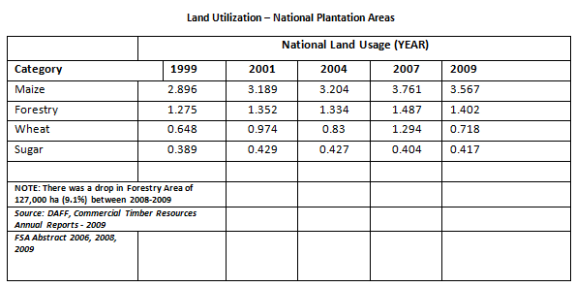

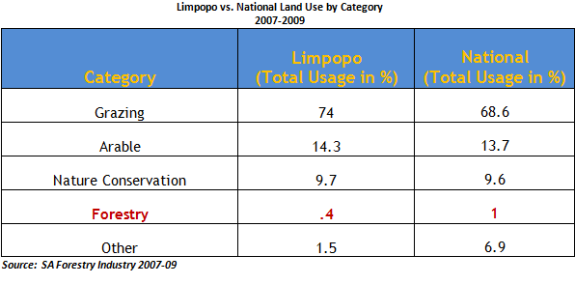

National Land Usage

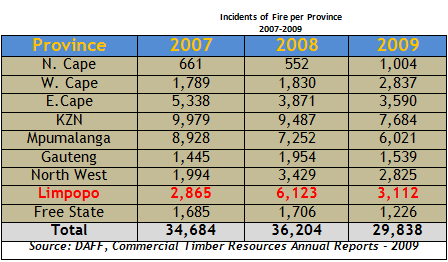

In terms of land usage, forest plantation covers approximately 1,257 million hectares (ha) of which 18,000 square kilometers are commercial forest areas. The forest sector and related forest products contribute 1% to the national GDP even as some forest areas and production dropped by 127,000 ha by late 2009. The decline is due to factors such as; withdrawals of forestry from riparian zones and wetlands, veld fires and a decrease in new investments in land claim pending areas.

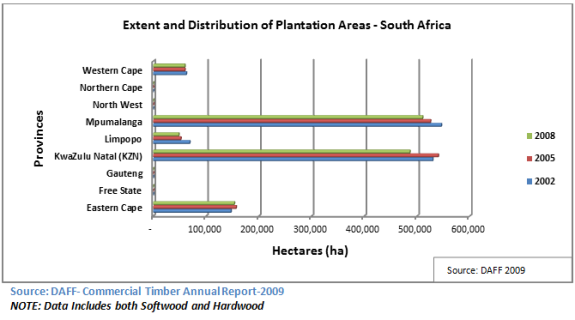

Main forestry areas are located along the Eastern and Northeastern sections of the country in the provinces of Mpumalanga and KwaZulu Natal with 6.24% and 5.31% of the provinces' overall land area. Smaller plantations are located in the Western Cape, Limpopo, and Eastern Cape. Here the percentages in the overall land area are 0.46%, 0.40%; and 0.90% respectively. Compared to this, nature conservation areas, however, make up 9.6% of the total land surface. Natural forests play only a very minor role in South African forestry (Godsmark 2009). The largest plantations at 80% per square kilometers are located in Mpumalanga, KwaZulu Natal (KZN) and the Eastern Cape provinces

Employment Factor of the Forestry Industry - Source FESA Annual Report 2010

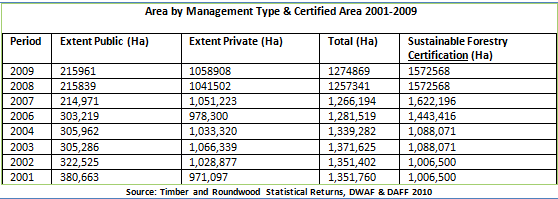

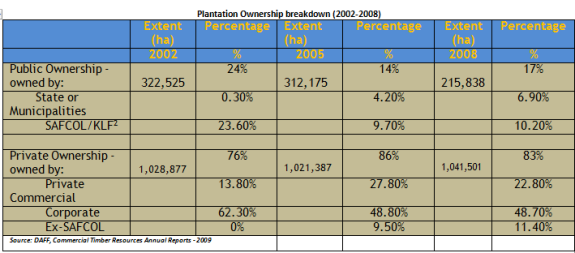

The sector has seen a huge participation by the private sector in terms of ownership and management. The change in the breakdown of ownership and distribution is presented below:

Commercial Plantation

Commercial plantation forestry in South Africa encompasses large planted forests (established to supply raw materials to satisfy mining, construction, and industrial markets) which supply the pulp-mills, sawmills and factories which process said raw materials. Wood is a key raw material to which value is added in many industries in our economy, for example in mining; construction of houses and commercial buildings, poles for electricity distribution and telecommunications; furniture manufacture; pulp and paper manufacture; and energy production. South Africa's demand for wood is met predominantly from commercial forest plantations, and not from natural resources or imports for the following reasons:

- natural forests provide little wood suitable as raw material for industry (although it does support a small but vibrant furniture industry)

- after the World War I, the Government focused on implementing policies of self�-sufficiency

- The influence of the commercial opportunities offered through a domestic source of low-�cost wood.

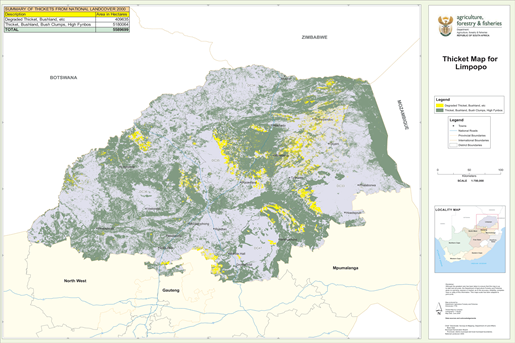

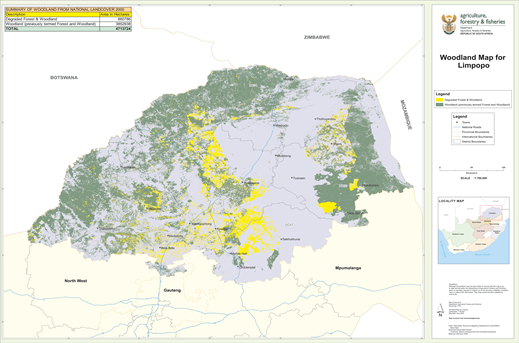

Map 1: Limpopo Thicket Description Area (ha) - 2000

Maps 1 and 2 present the spatial analysis of the agri-sector in Limpopo. The highest land use in forestry is broken down into the following specie groups:

- Thicket

- Woodland

- Eucalyptus

Socio-Economic Impact of Sector

Previously it was established that the forestry sector in the country was state sponsored and managed. Therefore it is not unexpected to see this as one of the most strategic economic sectors with significant contribution towards continued economic growth and job creation.

Forestry employed approximately 170,000 people in 2009. Forestry sub-sectors contributed to 77,000 direct and 30,000 indirect jobs. The Pulp and Paper subsector contributed employment figures of 13,000 and 11,000 direct and indirect, respectively. Other subsectors contributed as follows:

- Saw-milling = 20,000 workers

- Timber Board = 6, 000 workers

- Mining timber -subsector = 2,200 workers

- Miscellaneous forestry sub-sectors = 11, 000 workers

The total industry turnover in 2008 was R 21.4 billion with R 11.4 billion belonging to wood-pulp. The volumes in the subsectors were:

- Pulpwood = 13.8 million m3

- Mining Timber = 698,000 m3

- Charcoal = 271,000 m3

- Saw log = 4.4 million m3

- Veneer logs and Poles = 437,000 m3

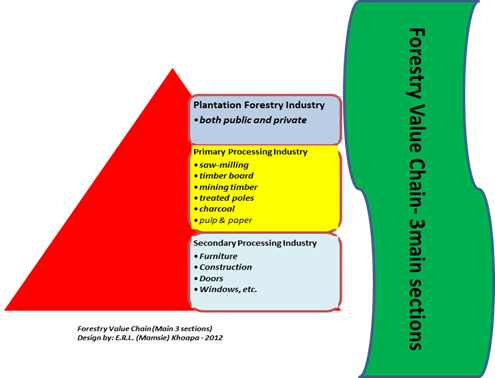

The Industry value-chain continues to have primarily three (3) sections, namely; plantation forestry, primary processing and secondary processing (FSA - 2010). The categorization for ease of understanding is presented in the table below.

Timber Industry - Limpopo Province

The Timber Industry is primarily located in the eastern region of Limpopo province. Forest plantations along the northern and eastern areas of Tzaneen contain pine and eucalyptus timber; namely, Woodbush - Magoebaskloof. Hardwood saw mills like Timbadola Sawmill and three softwood saw log plantations are located in Limpopo: Entabeni (14,000 ha), New Agatha (3,472 ha) and Woodbush (3, 606 ha) forming a base-regional economy. These are operated by Komatiland Forests.

Woodbush - Magoebaskloof, Limpopo

Source: DWAF- 2011

Eucalyptus Plantations Source: www.fao.org

Key Operators and Operations

In 2008-09 total investment exceeded R18.8 billion with breakdown as:

- 56.2% in tree planting and seedlings

- 24.6% in land

- 11.6% in road and access points

- 6.2% in fixed assets

Further investment breakdown in operations were:

- R15.8 billion = processing plants (book value)

- 84.7% = pulp & board plants

- 10.2 % = sawmills & veneer plants

- .7 % =pole plants,

- .3% = mining timber

- 4.1 % = other plants

The biggest lumber operator in Limpopo and the country is Hans Merensky Timbers (HMT). This Forestry Standard Certified (FSC Accreditation) company runs a large hardwood processor at their FSC sawmill dealing in eucalyptus hardwood. Unique drying methods produce high-quality woods mostly used in furniture manufacture, DIY products, flooring and the construction industry.

Due to the strategic-economic importance of industry to the Provincial Growth mandate, a BEE transaction of 26% (Wiphold & Vuka Forestry Holdings) took place in 2007. Shefeera Timbers (a former Mondi group, operates at Makhado dealing in sawn pine, treated poles, wooden pallets and retail. Further, IDC extended a debt-facility to Tzaneen Wood Plastic Composite that will employ up to 250 people. The facility will create fencing and decking material from wood plastic composite.

Transport Modal Usage and Transport Trends

In recent years most companies in this industry ideally want to use rail (Transnet Freight Rail) as the most cost effective mode. However, due to many challenges within TFR such as inefficiencies; costs and quality of service overall, the shift from rail to road continues at an alarming pace. Most of the companies surveyed in 2011 by FSA Timber Rail age Survey, supported the frustration and need to re-engage with TFR to either buy-out branch-lines and provide private operators to move their cargo instead of using road haulage. Of the companies surveyed in Mpumalanga 2010 during the updating of their Freight databank, inference can be made that similar findings can be recorded in Limpopo; i.e.

- Less than 20% of companies use rail exclusively.

- The majority have either moved to road using reverse logistics for sharing freight costs and vehicles.

- They would prefer rail age of product vs. road haulage

- They would prefer lower tariffs and less exorbitant annual tariff increases

- They would welcome improved levels of service from TFR

- If branch-lines are privatised, they would prefer entire logistics be privatised (i.e. branch-line operators be the same even on main-lines instead of TFR)

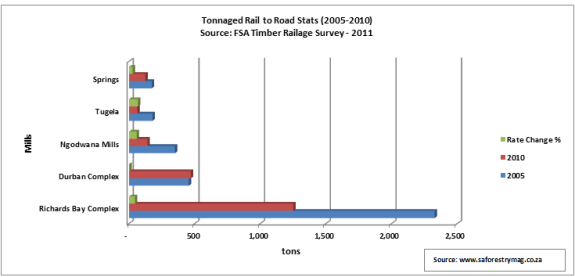

In the following graph, it is clear that the rail-road transition has increased from 2005-2010 for timber plantation to key-sawmills. The biggest differentials are observed between Tugela, Ngodwana, and Richards Bay at 68, 58 and 45%, respectively. The lowest rate of change is Durban at 3%.

Findings are that railed cargo dropped by 40% (2005-2010) translating to 1.4 million tons and more now on national roads.

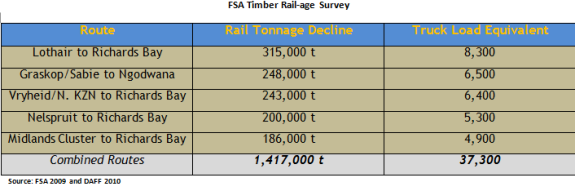

In the following table, further analysis was conducted on tonnage migration from rail to road and equivalent "truck-load" based on key routes. The greatest impacted roads on this study were the following; N2, R33, R603, R616, R74 and R622. Final reality in terms of road traffic and heavy-load haulage is that migration from rail to road will add 37,300 truck-loads (i.e. calculated at 38 ton loads per truck).

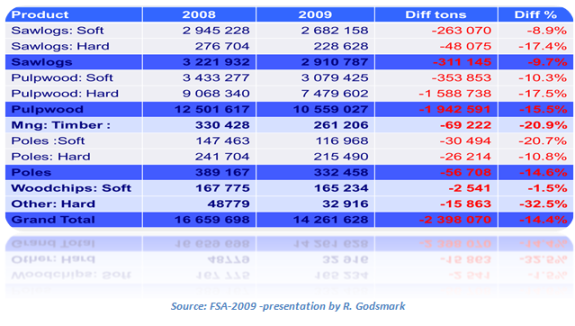

Given that the forestry industry is largely dependent on 'land-mass" (plantation hectares) of 50,000 to 100,000 plus hectares to be a major player, it has in the past remained competitive by using rail for product movement (export, import or domestic consumption). Forestry products especially in raw form is regarded as "dry-bulk" ; therefore, transportation by rail provides the best economies of scale especially as product is heavy and is usually destined for further centers of beneficiation/processing and eventual export or import. Thus moving over 14,261 million tons (nationally) in 2009 makes the case for demand that Freight Rail (Transnet) be more responsive to efficiencies and costing models that will facilitate transportation cost and industry competitiveness in the global markets. This continues to be an issue of contention as timber owners struggle to have better engagement with Transnet Freight Rail in regards to tariff increases as well as declining levels of service.

The next table shows price deferential between product species from 2008 to 2009. The importance of this variation is due to the increased levy (from 110 cents to 128 cents per ton) applied to industry by government; sales were significantly down. It has produced a deficit of 14.4% compared to 2008 figures.

Copyright © 2012 Limpopo Province Freight Transport Data Bank | Developed and Powered by Safiri South Africa.